Pros and Cons of Stem Cell

Treatment

Stem cell research is one of the most promising and exciting new technologies that

have emerged in the medical industry in recent years. It has the potential to make a

dramatic difference in the lives of patients suffering from various diseases and

injuries entertainment.suratkhabar, providing treatment that may not have been possible just a decade ago.

However, there are a number of pros and cons to using stem cell treatment for

medical conditions.

Pros of Cell Treatment

Compared to traditional medical treatments, stem cell therapy is an extremely cost-

effective solution for treating many orthopedic conditions and restoring mobility in

patients. In addition, it is a simple and quick procedure that is done in-office,

typically lasting only a few hours with a very brief recovery period.

At ThriveMD, we use adult stem cells to treat a variety of conditions, including

osteoarthritis, degenerative disc disease and facet joint injuries, as well as acute

sports injury rehabilitation. We are able to collect and inject these cells into the

affected areas using image guidance, triggering the body’s natural healing

processes and reducing or eliminating pain and other symptoms.

There are several different types of adult stem cells, but one of the most important

is induced pluripotent stem (iPS) cells. These are lab-engineered cells that can be

reprogrammed to act like embryonic stem cells. These can help scientists

understand more about developmental stages, illness initiation and progression, as

well as create and test new medications and treatments.

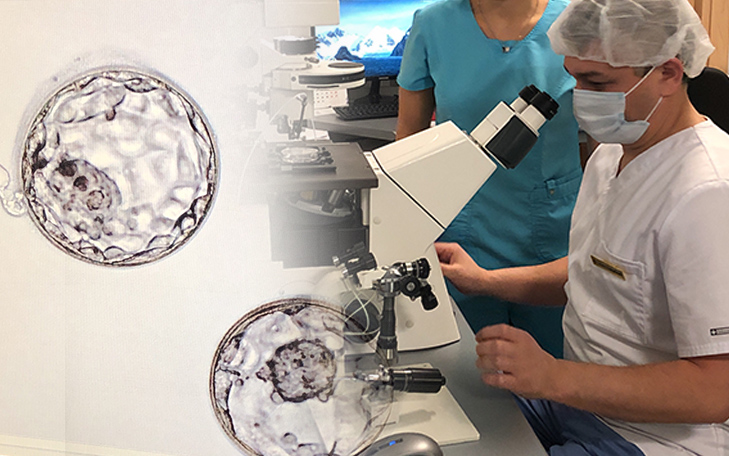

While iPS cells are currently in clinical trials, embryonic stem cells have long been

the main source of stem cell research. The major drawback to using these cells is

that they can be difficult to obtain, and many patients do not want to risk donating

their embryos to research purposes.

In addition, there are a number of ethical concerns surrounding embryonic stem cell

research, especially when it comes to using them for treating patients with a wide

range of health issues. For instance, embryonic stem cells have been known to

cause a number of future health problems for patients who receive them as part of a

treatment.

Other disadvantages of embryonic stem cell research include high rejection rates,

and the fact that they can be dangerous to human life if not used properly. They can

also lead to the development of tumors if they are not handled properly.

Another disadvantage of embryonic stem cell research is that it requires the

destruction of an embryo in order to obtain stem cells. It is therefore a controversial

topic that has raised a lot of debate and skepticism.

Lastly, there are other legal restrictions that limit stem cell research in some ways.

For example, some states ban stem cell research that uses embryos as a source for

cells.

Despite the numerous pros and cons of cell treatment, it remains an exciting

technology with the potential to revolutionize the way doctors treat patients. With

the right research and guidance, patients can benefit from these powerful treatment

options.

You hear it more and more. Termination of credit agreements and / or adjustment of the conditions (such as an increase in the surcharges and interest). An underexposed topic is the penalty interest charged by the banks. What can you do about it?

You hear it more and more. Termination of credit agreements and / or adjustment of the conditions (such as an increase in the surcharges and interest). An underexposed topic is the penalty interest charged by the banks. What can you do about it?